My wife and I have been digital nomads for 3 years, living in hotels in 25 countries, while working remotely. All the hacks and tricks we figured out along the way led to us spending even less money per year than we did before we started traveling!

We earned the highest-tier hotel statuses with Marriott, Hyatt, and Hilton which gives us free upgrades to luxury suites. This also gets us free daily breakfast, access to lounges with snacks and drinks, along with daily housekeeping, gym, pool, sauna, spa, etc. We haven’t had to clean our rooms, change our bed sheets, or take out the trash in years!

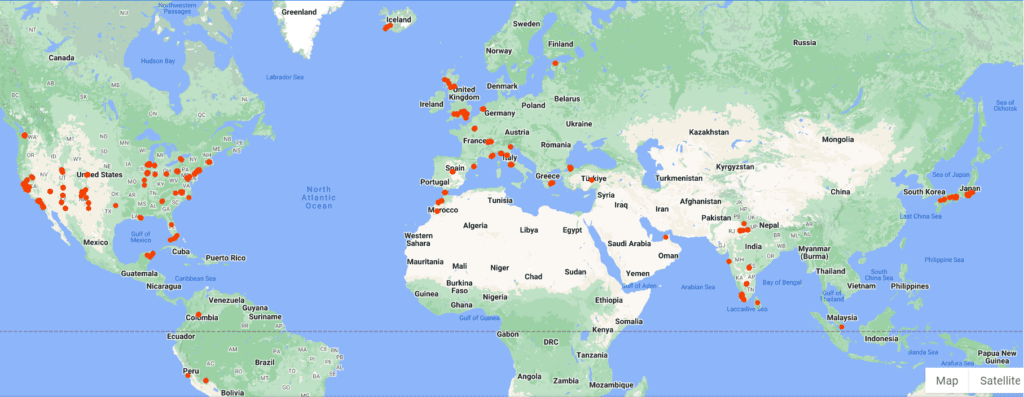

You can follow our adventures on Instagram and check out our 2023 highlights reel. Here is a map of all the cities we visited in the last 3 years:

Table of Contents

Hotel Costs

Hotels cost us on average less than $150 per night over the last 3 years. In expensive cities, we sometimes paid $200 to $300, while in cheaper cities it could be less than $100 per night.

We earn roughly 16% back in hotel points (for example, 17.5x Marriott points with Titanium status), 6% back in credit card points, and 3% back by clicking through Rakuten to book. This totals to 25% back per dollar of hotel spend.

So essentially, we pay for 8 months of rent and get 2 months free with these points. We don’t have to pay rent for the remaining 2 months per year since we spend 3-4 weeks at work conferences and 5-6 weeks visiting our families.

Therefore, our total cost for accommodation in an entire year is approximately 8 * 30 * 150 = $36,000 per year, which translates to an average of $3000 per month, i.e., $1,500 per person per month.

We used to pay about the same $1500 monthly rent per person when we lived in the San Francisco Bay Area and New York City. However, on top of that $36,000 yearly rent, we had to pay extra on hotels during the 3-4 weeks we went on vacation! So it’s actually cheaper for us to live in hotels all year.

Credit Card Bonuses

We also earn an extra 100,000 points every couple of months as a signup bonus by opening a new credit card and charging all these hotels to meet the spending criteria

Some of the US cards each of us have cycled through include Amex Platinum, Gold, Green, Capital One Venture and Venture X, Chase Sapphire Preferred and Reserve, Citi Premier, and Bilt. We also got a few hotel credit cards each including those from Marriott, Hyatt, and Hilton. We haven’t started getting the airlines cards yet.

Doctor of Credit maintains a great up-to-date list of the best credit card signup bonuses right now: https://www.doctorofcredit.com/best-current-credit-card-sign-bonuses/

Whenever possible, we downgrade each card to a free version without annual fees after exactly one year, instead of canceling (so that it doesn’t affect our credit score much). Even after opening 10 credit cards each in the last 3 years, we both still have credit scores above 780. As long as you pay off your entire balance every month, your credit score goes up even higher in the long run after the temporary dip each time you open a new card.

Traveling Tips

We use most of the points we earn through those signup bonuses to fly business class on all the long-haul flights (more than 6 hours). Usually, we book short flights (or trains) and slowly hop to nearby countries and cities to minimize jet lag. For local transportation, we use Uber or public transportation (which is typically very good outside the US). We also like to book day trips and guided tours, with good ratings on GetYourGuide or TripAdvisor, to see attractions that we would otherwise have to drive to.

Travel Insurance: A lot of these credit cards cover travel insurance and medical emergencies while you’re traveling abroad. Healthcare is also cheap in most countries other than the US.

Paying for stuff: Make sure to use credit cards which don’t charge foreign transaction fees when making purchases abroad. Almost every country takes Visa and Mastercard credit cards at stores and restaurants, so we have rarely needed any physical cash.

Getting cash: Never use foreign currency exchanges since they always rip you off by marking up the exchange rate by 5% or more. The best way to get local currency is to use either the Charles Schwab or Fidelity debit cards to withdraw cash directly from any ATM anywhere in the world. These debit cards don’t charge any currency conversion fees and they refund you all the fees and surcharges (usually $5 to $10) that ATM providers charge. Only use debit cards for getting cash, never use them for any purchases since they don’t have the same fraud protections that credit cards do.

Avoid DCC: If given the choice to pay in US dollars (or whatever is your home currency) and the local currency of the country you’re currently visiting, pick the local currency. Never choose to pay in US dollars (or your home currency) when abroad or you’ll end up paying 7% extra for Dynamic Currency Conversion.

Food

We get the free hotel breakfast and then eat every lunch and dinner at restaurants. This costs us an average of $1000 per person per month. In the most expensive cities like New York and Geneva it cost up to $2000 but in other countries like India it cost less than $300 (since an average meal was less than $5 per person!)

Even before we started traveling, we used to eat out or order Uber Eats every day since neither of us likes to cook. So now we get to eat at thousands of different restaurants and experience an incredible variety of authentic cuisines from all over the world!

Total Expenses

Our total yearly expenses were roughly $35,000 per person per year i.e. $70,000 for us combined. This includes $18,000 for hotels, $12,000 for food, and $5000 for everything else.

Monthly breakdown: The average expenses per person per month was roughly $1500 for rent, $1000 for food, and $420 for all other things (like Ubers, shopping, phone bill, tours, etc.)

Address and Taxes

Our only legal permanent residential address is our parent’s home since we spend more than a month here every year (which is longer than we stay anywhere else since we change hotels every 2-3 weeks). We also store some of our belongings here throughout the year. Our mail and credit cards are sent to our parent’s home and they send us photos.

We make sure not to stay more than a month or two in any country to avoid personal tax liabilities and also get digital nomad visas which exempt local taxes when possible. We don’t spend enough time in any other US state to establish residency there.

I was also able to legally reduce my total tax liability by traveling so much that I became a non-resident in the US but that is a story I’ll write about in another article!

Working Remotely

Both of us are computer scientists specializing in AI. We work New York-hours remotely during weekdays and explore the cities in the evenings (or mornings depending on time zone) and weekends. We make sure to travel or move hotels only during weekends or holidays.

When we traveled to places with extreme time zone differences like Japan, we used our vacation days.

Packing Light

When we started traveling, we used to each have a backpack and a carry-on suitcase. Over the last 3 years, we realized that most of our luggage was unnecessary. So we slowly got rid of everything we didn’t need.

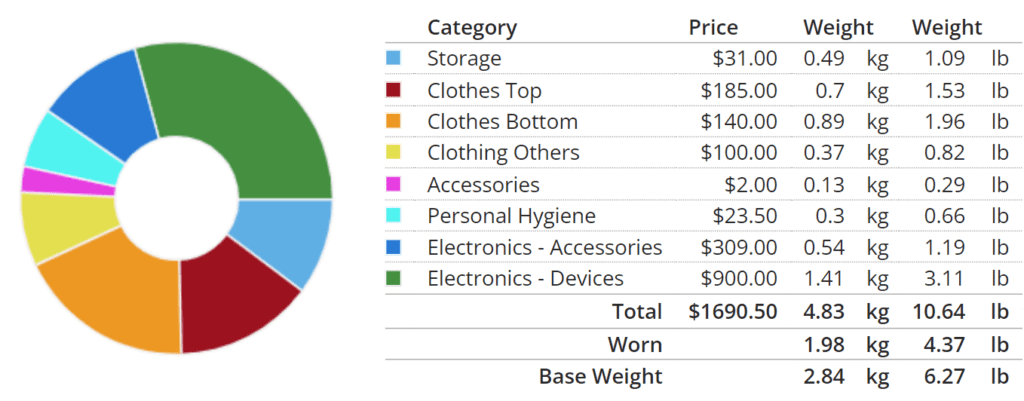

Now I only have 35 different items, which weigh less than 11 pounds combined and fits in a tiny backpack. Also the cost of everything I own in the entire world adds up to only $1700 in total and can be easily replaced.

Below is the breakdown by category of my optimized “onebag” setup:

You can find the detailed list with links to every item I own along with the cost and weight here: https://lighterpack.com/e/r08kbs

The key to traveling light is to get the right materials like merino wool which is odor-resistant and dries quickly. You can layer these clothes in different combinations for all climates, especially if you add a warm ultralight packable down jacket. You can quickly do your own laundry in the hotel sink in the evening and it dries by the morning.

The subreddit r/onebag is a great resource to get inspired and learn how to optimize your baggage to weigh as little as possible.

Favorite Places

Of all the countries we’ve visited so far, our favorite ones are Japan (both of us agree it’s number 1 by far), Peru, Sri Lanka, Iceland, Turkey, Greece, and Italy.

You can see our favorite moments in this highlights reel.

Some of the best 5-star hotels that we really enjoyed staying at recently include:

- Andaz Mayakoba, Mexico (beautiful biking trails, boat rides, beach, mangroves, lagoon)

- JW Marriott Cusco, Peru (baby alpaca to play with, private cooking class with Chef)

- Palacio Del Inka in Cusco, Peru (Inca music performance, incredible thermal spa)

- Oberoi Amarvillas in Agra, India (palace with direct view of the Taj Mahal, amazing food)

- Miyako Kyoto, Japan (three beautiful gardens, onsen, and bird watching trail)

- Prince Gallery Tokyo, Japan (1022 sq feet corner suite with 180° view of Tokyo)

- Indigo Hakone in Japan (traditional Japanese suite with private onsen in-room)

- Jetwing at Sigiriya in Sri Lanka (floating cottage with two private pools and peacocks)

- Kumarakom Lake Resort in Kerala, India (suite with private pool and a house boat)

- Marriott Mena House Hotel in Cairo, Egypt (direct view of the Pyramids of Giza from our room, 5 minutes walking distance away)

- Rabat Marriott in Morocco

- Waldorf Astoria in New Orleans, US

Future Plans

We started out thinking we’ll travel for just a few months and then settle down in another apartment. But it was so much fun and not as exhausting as we thought it would be. We even tried settling down last year but realized we really wanted to hit the road again after 3 months. Booking a hotel and flight every few weeks becomes a quick mindless routine eventually.

Where are we going next? Cancun (Mexico), Cairo and Luxor (Egypt), South India, Singapore, Mexico City.

Can we keep doing this forever? Probably not. We’ll eventually settle down when we’re tired of traveling or if we have kids someday. There’s still miles to go before we stop.